Did You Know,

If you are falling under any one of the following categories of persons, GST registration is compulsory, irrespective of your turnover, and avail the various benefits of GST registration such as Seamless flow of credit, ease of doing business, failing to register under compulsory registration, may attract heavy penalties,

Are you a Person making any inter-State taxable supply?

Are you a Casual taxable person making taxable supply?

Are you a Person who is required to pay tax under reverse charge mechanism (RCM)?

Are you an Electronic Commerce Operator and Electronic Commerce Supplier?

Are you a Non-resident taxable persons making taxable supply in India?

Are you a Person who is required to deduct tax under section 51?

Are you a an agent or otherwise?

Are you an Input Service Distributor?

Are you a person supplying online information and data base access or retrieval (OIDAR) services from a place outside India to an unregistered person in India?

Are you a Person Registering for Udyog Aadhar?

Are you Such other person or class of persons as may be notified by the Government on the recommendations of the Council?

Let us quickly understand the basics of GST, before we understand the various categories of persons to whom compulsory registration under GST is applicable,

What is Goods and Services Tax (GST)?

GST is an Indirect Tax in the form of Value Added Tax, a Continuous Chain of Tax is levied on the supply of goods and services in India, burden of which is borne by the Final Consumer and there is No cascading of Taxes where credit of Input Taxes (ITC) been taken at each level of suppliers.

There are 4 types of Taxes as per GST laws,

-For Intra-State Sales: within the State,

Central Goods and Services Tax (CGST),

State Goods and Services Tax (SGST), OR Union Territory Goods and Services Tax (UTGST),

-For Inter-State Sales: Between 2 different States,

Integrated Goods and Services Tax (IGST)- is a mechanism for adjusted Credit.

GST Registration

GST Registration means the allotment of a unique GST number with 15 digits or GSTIN based on PAN, to a taxpayer who is liable to collect and pay tax to the government after claiming the credit of the taxes paid on purchases.

Generally, the GST registration is compulsory only if the Aggregate Turnover of a business exceeds the threshold limit during the financial year.

However, in certain categories of person, compulsory registration under GST is required even if the aggregate turnover is less than the prescribed threshold limit or exemption limit and are exempted from GST.

A taxpayer can apply for GST Registration on GST Portal.

A supplier, whether a trader, manufacturer, wholesaler, importer, distributor, or retailer, who wants to pass on the GST credit on goods imported or traded by him to the final customers would need to get himself registered under the GST laws.

Taxable Person

Taxable Person means a person who is either registered or required to be registered under Section 22 or 24 of this Act.

A person may either register voluntarily on his own or through compulsory registration.

One who is required to obtain multiple registrations in different States or within one State would be considered as distinct person in each State but the Aggregate Turnover is PAN based across the country.

Compulsory Registration Under GST

Persons making any inter-State taxable supply,

Inter State Supply means the location of the supplier and the place of supply are in different states or different territories.

Inter-state supply means sales of goods outside the state of registration.

A persons making any inter-State taxable supply of goods is required to be registered under GST irrespective of turnover limit.

Exemption from compulsory GST registration, even if making interstate supply, provided aggregate turnover is less than Rs.20 or10 Lacs per annum, in case of Inter-state supply of services, handicraft goods, A job worker,(except for Jewellery, goldsmiths’ and silversmiths’ wares and other articles manufactured on job work basis).

Example, If you are selling clothes from Maharashtra to Karnataka, which is inter-state taxable supply, you are required to take compulsory GST registration and charge IGST on invoice raised.

Casual taxable persons making taxable supply As per section 24 of CGST Act 2017,

A Casual taxable person, means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory, where he has no fixed place of business.

Exemption from compulsory GST registration, even if not having fixed place of business, provided aggregate turnover is less than Rs.20 or10 Lacs per annum, handicraft goods.

Example, If you are a dress designer and, having a place of business in Gurgaon and want to sell your dresses in an exhibition in Mumbai, but have no fixed place of business in Mumbai. In the given case, according to section 24, you are required to take compulsory GST registration in Mumbai before providing such services.

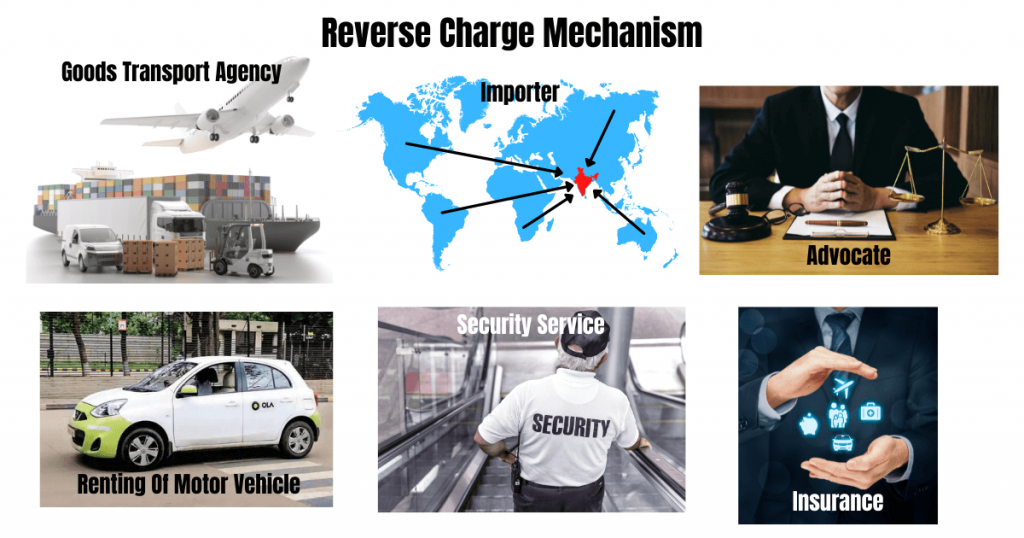

Persons who are required to pay tax under reverse charge,

A person who is required to pay tax under reverse charge has to take compulsory registration as he has to take registration to submit tax under reverse charge.

The important point should be taken into consideration that Section 24 overrides sec 22 only so any person who is exclusively in the business under section 23 i.e. any person engaged exclusively in the business of supplying goods or services not liable to tax or wholly exempt from tax then he is not required to get himself registered.

A Person engaged exclusively in manufacture of exempted product receiving GTA service which is under reverse charge would require registration under CGST Act in order to discharge his duty liability under reverse charge.

In case of mandatory RCM, the service recipient is compulsorily liable to pay tax and all the provision of GST law shall apply to such recipient as if he is the person liable for paying the tax.

On account of this, the provisions of section 24 are introduced for mandatory registration in such cases.

Exception: Services by a partnership firm of Advocates/individual Advocate/Sr Advocate by way of legal services to a business entity with aggregated turnover below the threshold limit u/s 22(1).

It is relevant to note that a supplier who is making only reverse charge supplies is not required to register if his aggregate turnover of supplies is less than the exemption limit.

Example, If you have taken Lawyer consultation, you will have to pay GST under RCM. The lawyer is not entitled to collect GST from you and pay to the government. So, he will raise an invoice to you, only for the work done at Gross value without adding GST.

Example, If you, as a buyer, have paid the freight and collected goods from the Goods Transport Agency, then you will have to pay GST on the same under RCM at 5%.

Electronic Commerce Operator Electronic Commerce Operator who is required to collect tax at source under section 52/TCS collector,

An e-commerce operator is a person who owns and manages a digital platform for an e-commerce business, buy and sell goods or services or both over an internet/electronic network, not having any physical presence in the taxable territory, who is required to collect Tax at Source, before making payments to the e-commerce suppliers.

An e-commerce supplier is a Person, who supplies goods or services or both, other than specified supplies through the e-commerce operator.

However, persons who are suppliers of service and supplying services through e-commerce operator are not required to register under GST if their aggregate turnover is less than Rs 20 lakhs per annum (Rs 10 lakhs in case of specified States).

Example of e-commerce operator; Amazon, Flipkart, Meesho, Udaan, Snapdeal, Shopclues, Indiamart facilitate suppliers to sell their products through Amazon, Flipkart, Meesho, Udaan, Snapdeal, Shopclues, Indiamart and other online platforms/apps, which deducts TCS.

Following are specified categories where E-commerce operators has to register compulsorily under GST ,

i)Transportation of passengers by a radio-taxi, motor cab, maxi cab, motorcycle, omnibus and other motor vehicle Example, Ola, Uber

ii) accommodation in hotels, inns, guest houses, clubs, campsites, etc for residential/lodging purpose Example, Oyo.

iii) Services by way of housekeeping, such as plumbing, carpentering Example, Urban Clap.

iv)supply of restaurant services supplied by restaurant, eating joints, etc located at specified premises. Example, Swiggy, Zomato.

Example, If you, as a supplier have sold goods worth Rs.10,000/- plus GST @ 18% with a total sales value of Rs.11,800/- to the consumer through Amazon, then Amazon shall collect the full amount from the consumer of Rs.11,800/-, deduct TCS @1% of Rs.10,000 from the sale value of Rs.11,800/- and pay you Rs.11,700/-(Rs.11,800-Rs.100).

Amazon will also charge its Commission say Rs.200 plus GST from you, for selling on your behalf on its platform.

Non-resident taxable persons making taxable supply,

”Non-resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as a principal or agent or in any other capacity, but who has no fixed place of business or residence in India;

Every NRI individual or company making taxable supply has to register under the GST regime, irrespective of frequency and amount of transaction involved.

Example, If you, as an NRI, visit India, to sell your goods, then, you will have to apply for GST and pay taxes accordingly in India.

Persons who are required to deduct tax under section 51, whether or not separately registered under this Act,

A person who is required to deduct TDS are,

The authorities as notified a department or establishment of the Central Government or State Government; or

local authority; or

Governmental agencies; or

such persons or category of persons as may be notified by the Government are required to get itself registered under GST compulsorily.

Example, If you are a supplier to a Government entity, and the Government has deducted TDS on payments made to you, then such Government entity will deduct TDS @1% from the value of supply excluding GST, before making such payment to you.

Persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise,

A person who is working as an agent or otherwise and also making taxable supply on behalf of such other person, has to get himself registered under GST compulsorily.

“Agent” means a person, including a factor, broker, commission agent, del credere agent, arhatia, an auctioneer or any other mercantile agent, by whatever name called, who carries on the business of supply or receipt of goods or services or both on behalf of another.

Commission Agent- The agent receives a % as commission on the value of supply, for the transactions which are not done through him. He has to get registered under GST only when aggregate turnover is less than Rs 20/10 lacs.

Carry & Forwarding Agent-The agent receives a commission for the transaction which is routed through him and invoice is raised by him in his own capacity.

Input Service Distributor, whether or not separately registered under this Act,

Input Service Distributor (ISD) means an office of the supplier of goods or services or both, which receives tax invoices issued under section 31 towards the receipt of input services and

issues a prescribed document for the purposes of distributing the credit of central tax, State tax, integrated tax or Union territory tax paid on the said services to a such branches/supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office by raising an ISD invoice.

Example, If you have a head office in Mumbai, and branches in Delhi, Calcutta and Bangalore. If you have incurred Software maintenance expenses for all, received tax invoice for the same with GST, the software is used by all the branches, and hence you will distribute the credit of Input Tax credit to all the branches. Hence you are an Input Service Distributor.

Every person supplying online information and data base access or retrieval (OIDAR) services from a place outside India to a person in India, other than a registered person,

OIDAR services refer to services provided through the medium of the internet without the physical interaction of the supplier and recipient of services.

As per the above provision if a person is supplying online information and data base access or retrieval from outside India, then that person has to get itself registered through an authorised representative in India, under GST irrespective of the turnover in the previous year.

Example, Advertising on the internet, providing cloud services, online supplies of digital content, digital data storage, online gaming, etc.

Netflix providing services outside India then, Netflix has to get itself registered and pay GST under normal charge.

Person registering for Udyog Aadhar,

GST registration is compulsory- Udyog Aadhar also known as Aadhar for Business, is a government registration certificate with a unique number, for manufacturing or service sector, is a new way of getting MSME registration, benefits of which are easy sanction of bank loans, lower rates of interest, the exemption under Direct Tax Laws and many more.

Example, If you are applying for Udyog Aadhar, GST number is compulsory.

Such other person or class of persons as may be notified by the Government on the recommendations of the Council.

Conclusion,

Is GST mandatory for online business?

Yes, It is compulsory to register under GST, if you are selling through E commerce platforms such as Amazon, Indiamart, who is liable to collect TCS . But if you are selling on your own Website, then GST registration will be applicable only when you cross the threshold limit of Rs.20/10/40Lacs respectively.

Can we register on Amazon without GST?

It is mandatory to have a GST number for every supply of goods through Amazon. However, persons who are suppliers of service and supplying services through e-commerce operator are not required to register under GST if their aggregate turnover is less than Rs 20 lakhs per annum (Rs 10 lakhs in case of specified States).

Who are the Persons compulsory liable for GST registration?

If you are making taxable supply through Inter-State Sales, a Casual Taxable Person, NRI, Agent, C&F agent, or a Person liable to pay tax under RCM,E commerce Operator, E commerce supplier, Input Service Distributor, or a Person like Netflix supplying online Information, or are applying of Udyog Aadhar, or any such other notified person.

If you are any one of the categories of persons discussed above, subject to some exemptions and exceptions, irrespective of your turnover, you have to apply for compulsory registration under GST and comply with the GST laws accordingly, thereby saving yourself from penalties in case of failure to register, and enjoy the various benefits of GST.